“Asset loans” – at very high interest rates – are particularly attractive to financially distressed borrowers who ...

Lender reclaims Toowong unit after 5-yr default on incorrectly signed loan docs

An international flight attendant who had no recollection of signing loan documents for the advance of $265k for her Too...

Broker fakes income & expenses: court writes off $1.5 mil from unaffordable loan

A couple who signed an almost blank home loan application that they left to their broker to complete have been granted &...

High Court rules “asset” loan to borrower with no capacity to repay, unconscionable

Asset lending is done on the basis of the value of the assets securing the loan without regard to the borrower’s capacit...

Judge attacks consumer body for delay in adjudicating financial services complaints

A Brisbane court has rebuked the Federal financial complaints body for prolonged delays in its adjudication of financial...

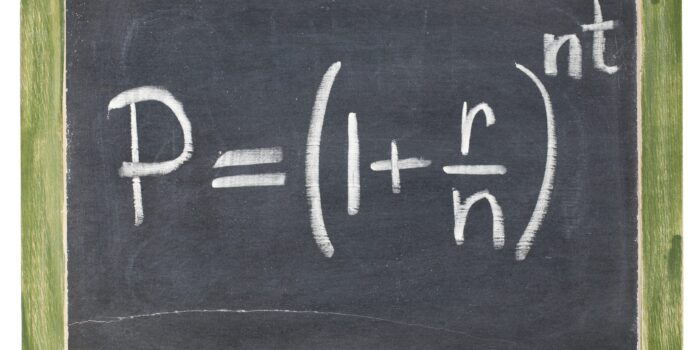

High Court approves compound interest magic as financier collects 30 x debt after 20 yrs

Australia’s highest court – in confirming that the waiver of statutory consumer protections by contract or agreement is permissible –

Loan book buyer statute barred in $4 mil mortgage debt recovery

Borrowers under a private $320k loan have successfully defended their mortgagee’s $4 mil recovery action claim by

Whitsunday developer’s $3 mil loan default compounds to $11 mil at judgment

One would have thought that all the stories of GFC related property calamities in Queensland had been told

Court orders halt to recovery action on “predatory” loans to desperate business

Private loans with “stratospheric” interest rates exploited the financial desperation of a novice businessman, it has be...